Why Nobody Believes The “Data”: Surging Prices Of Everyday Items Are Excluded From CPI

As inflation remains painfully high for American consumers, the Consumer Price Index (CPI) is woefully inadequate in terms of reflecting reality.

For starters, CPI excludes several significant costs faced by households today – ranging from property taxes to soaring interest payments.

While price levels remain notably higher than before the pandemic, according to the CPI, inflation has slowed – reaching a 2.4% increase for the year ending in September. That’s only part of the picture, Bloomberg reports.

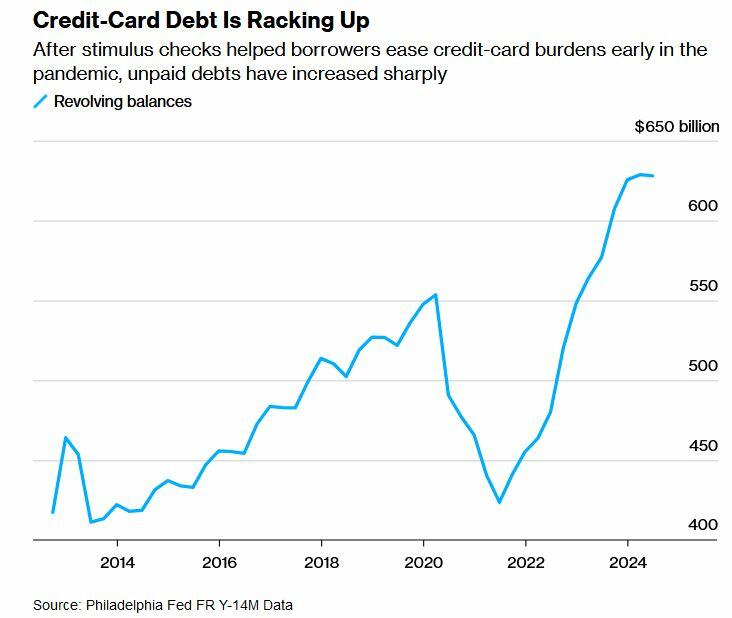

“The CPI is capturing the goods and services that you purchased for consumption, but there are things that affect your cost of living that are outside of that,” explains Steve Reed, a BLS economist. For instance, interest charges on rising consumer debt are largely absent from the CPI. Roughly $628 billion in revolving credit card debt now bears an average interest rate of about 22%, yet these costs aren’t reflected in consumer inflation data.

“It’s one thing that’s definitely impacting the way people spend money,” said Pete Earle, economist at the American Institute for Economic Research and creator of the everyday price index that aims to track daily purchases that can’t be easily avoided. “It’s not really inflation, but it’s definitely something that should be taken into account.”

Another gap in the CPI is its exclusion of property-related expenses. While it measures the cost of personal property insurance, it overlooks the cost of insuring the physical home – a critical oversight as climate-related risks drive premiums higher. According to Bloomberg analyst Andrew John Stevenson, omitting this from the CPI means that rising insurance premiums are only partially reflected in the overall inflation data.

The CPI’s “basket” also leaves out several items that have become significant in Americans’ budgets, including restaurant tips. Similarly, legal but selectively regulated goods, such as marijuana in some states, and gambling expenses remain unaccounted for. This reality adds to the perception that official inflation metrics don’t fully capture the true cost of living for many Americans.

The BLS admits that CPI falls short, writing on its website: “The CPI does not necessarily measure your own experience with price change,” adding “A national average reflects millions of individual price experiences; it seldom mirrors a particular consumer’s experience.”

The pricing challenges aren’t unique to the CPI. For example, the personal consumption expenditures price index, produced by the Bureau of Economic Analysis, also has some quirks when it comes to measuring certain expenses like health care. While the Fed prefers the PCE gauge, White House economists say that the CPI tends to more closely track consumers’ actual out-of-pocket spending. -Bloomberg

While inflation may appear to be abating on paper, Americans’ financial reality is more complex – influenced by costs that extend beyond the basket of goods traditionally tracked by federal data.