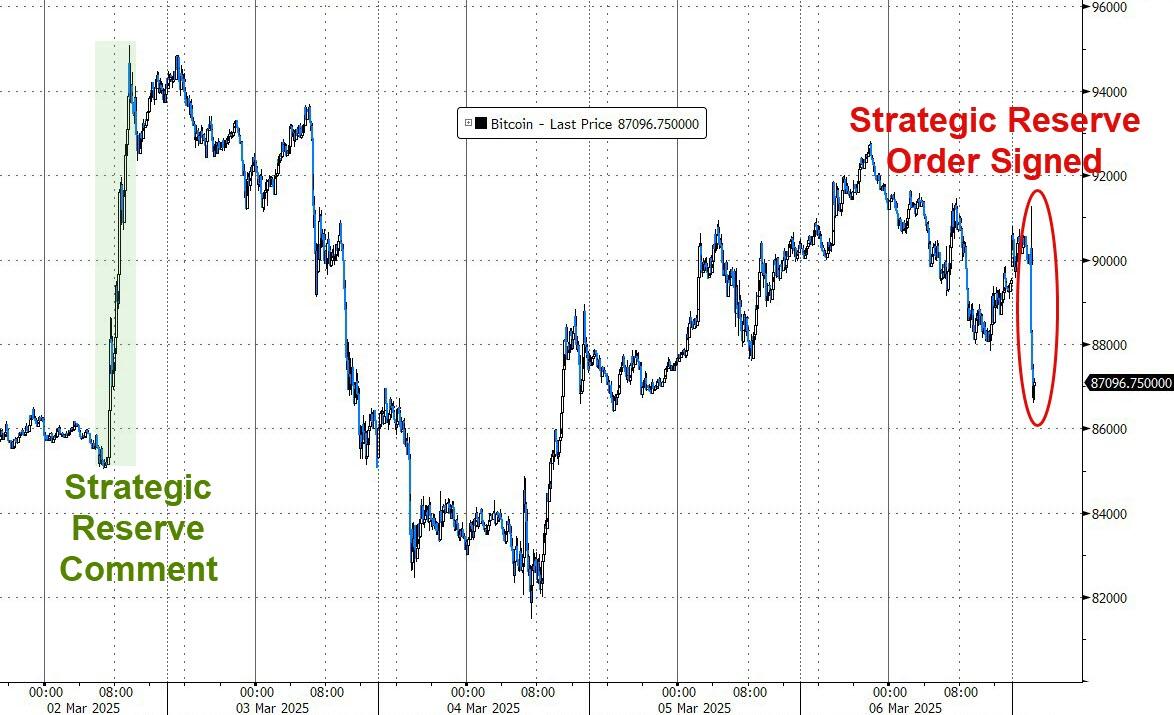

Bitcoin Slides After Trump Signs Strategic Reserve Executive Order

After hinting at it to start the week, President Trump just signed an executive order on Thursday creating a Strategic Bitcoin Reserve, marking a major shift in U.S. digital asset policy.

But many crypto enthusiasts are a littel disappointed (and price action is reflecting that currently), as instead of acquiring crypto assets, White House Crypto and AI Czar David Sacks, a Silicon Valley venture capitalist, wrote in a post on X that the reserve will be funded exclusively with bitcoin seized in criminal and civil forfeiture cases, ensuring that taxpayers bear no financial burden…

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings.

This means it will not cost taxpayers a dime.

It is estimated that the U.S. government owns about 200,000 bitcoin; however, there has never been a complete audit. The E.O. directs a full accounting of the federal government’s digital asset holdings.

The U.S. will not sell any bitcoin deposited into the Reserve. It will be kept as a store of value.

The Reserve is like a digital Fort Knox for the cryptocurrency often called “digital gold.”

Premature sales of bitcoin have already cost U.S. taxpayers over $17 billion in lost value.

Now the federal government will have a strategy to maximize the value of its holdings.

The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies have no incremental costs on American taxpayers.

IN ADDITION, the Executive Order establishes a U.S. Digital Asset Stockpile, consisting of digital assets other than bitcoin forfeited in criminal or civil proceedings.

The government will not acquire additional assets for the Stockpile beyond those obtained through forfeiture proceedings.

The purpose of the Stockpile is responsible stewardship of the government’s digital assets under the Treasury Department.

PROMISES MADE, PROMISES KEPT

President Trump promised to create a Strategic Bitcoin Reserve and Digital Asset Stockpile. Those promises have been kept.

This Executive Order underscores President Trump’s commitment to making the U.S. the “crypto capital of the world.”

I want to thank the President for his leadership and vision in supporting this cutting-edge technology and for his rapid execution in supporting the digital asset industry. His administration is truly moving at “tech speed.”

I also want to thank the President’s Working Group on Digital Asset Markets — especially Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick — for their help and support in getting this done. Finally Bo Hines played a critical role as Executive Director of our Working Group.

Bitcoin is down around $3,000 on the news, holding above the levels seen before President Trump’s posts on Sunday…

Steven Lubka, head of private clients and family offices at bitcoin-focused financial service firm Swan Bitcoin, said while having a stockpile could be a good first step, he eventually hopes to see a crypto reserve where the U.S. government would buy and accumulate bitcoin.

“They can hold onto seized assets and create a stockpile, but a stockpile is different from a strategic reserve, which would presumably involve purchasing assets and actively going into the markets to acquire or trade them,” Ian Katz, analyst at policy research firm Capital Alpha Partners, told MarketWatch.

“The consensus on Capitol Hill is that it would require an act of Congress, and is unlikely to happen,” Katz said.

A crypto stockpile is likely already priced in, Lubka said.

“The stockpile is good mostly on a signaling and a narrative basis, rather than [it being] really about the sales,” Lubka said.

On the bright side, this order removes the constant overhang FUD that the US government will dump its holdings on the market at an inconvenient time, though “it would be good to have a congressional mandate over time to make the crypto stockpile or reserve protected from the next administration,” Seth Ginns, head of liquid investments at crypto investment firm CoinFund told MarketWatch in a phone interview.

Whether the U.S. government holds or trades crypto, “that doesn’t really matter, because it’s more like a feather in the cap of legitimacy and use-case for this asset,” Sue Ennis, head of investor relations at crypto-mining company Hut 8.